my Tax Calculator Australia

Wanting a quick and easy way to calculate various Australian tax liabilities? Tried to do it online but there is too many places to go or you couldnt get internet service to use them? Tried other tax apps from the app store and they only do part of the job, or even worse give the wrong result? my Tax is the app for you!

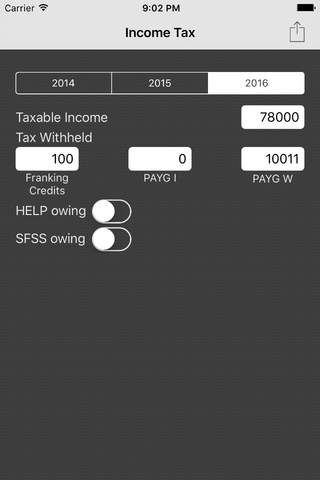

my Tax has been developed by an Australian Chartered Accountant for your Australian iPhone and iPad. my Tax can be used to calculate:

- Annual personal tax liability (including HELP, tax withheld, medicare levy and low income rebate)

- Period PAYG Withholding (weekly, fortnightly, monthly and quarterly) including HELP, leave loading and tax free threshhold

- The benefit of salary sacrificing a vehicle using the statutory method or logbook method

- The benefit of salary sacrificing superannuation

- Goods and Services Tax (GST) based on an entered GST exclusive or inclusive amount and allowing for any GST free amounts

- Fringe Benefits Tax (FBT) payable based on entered Type 1 and Type 2 total benefit amounts

- Loan calculator to work out the amount of a loan repayment, the remaining number of payments or the amount you can borrow based on other information entered.

- Key tax rates summary for quick access to tax rates you need on the go

- my Pay calculator to work out what you will get paid.

- Capital Gains Tax (CGT) calculator for individuals to work out the extra tax you will pay if you sell your shares, investment property or other capital asset for a profit.

Other features include

- Status bar updates in iPhone as you type to give you the result

- Ability to generate PDF reports

- Print reports directly from your device to supported printers

- Built in calculator with quick tax calculator functions

- customisable tabs to put your four most used calculators on the main screen

- dark mode support

As an accountant I am using the app in my daily work whilst on the phone and out visiting clients.

You too can use it whether your an individual looking to work out your tax or the benefits of salary sacrifice, a bookkeeper working out GST for data entry through to an accountant dealing with clients.

Other:

Extreme care has been taken to ensure the calculator gives accurate results. However, calculations should be considered indicative only and professional advice sought specific to your circumstances.